“[T]he customary band of pickets” was how a 1953 New York Times article dismissively termed Tax Day demonstrators from WRL, Catholic Worker, and the Peacemakers outside the Manhattan IRS. The article went on to report “they either refused to pay Federal income taxes or sympathized with those who did not because ‘the huge program of armaments can only lead to a third world war.’”

“[T]he customary band of pickets” was how a 1953 New York Times article dismissively termed Tax Day demonstrators from WRL, Catholic Worker, and the Peacemakers outside the Manhattan IRS. The article went on to report “they either refused to pay Federal income taxes or sympathized with those who did not because ‘the huge program of armaments can only lead to a third world war.’”

Following World War II, the Pentagon’s appetite for weaponry did not abate for long, requiring an insatiable need for money, bringing to mind A.J. Muste's aphorism “The two decisive powers of the government with respect to war are the power to conscript and the power to tax.”

At least since 1950, WRL with other pacifist groups held annual Tax Day pickets at the IRS in NYC as well as other cities across the country. These demonstrations continue to the present.

Organizationally, WRL did not take a stand against paying taxes until 1956 when newly-hired staff member Ralph DiGia requested federal income taxes not be withheld from his WRL salary. Then in 1966, the WRL initiated the national “Hang Up on War” campaign, encouraging the refusal to pay the war-related federal excise tax on telephone service (then at 10%).

Organizationally, WRL did not take a stand against paying taxes until 1956 when newly-hired staff member Ralph DiGia requested federal income taxes not be withheld from his WRL salary. Then in 1966, the WRL initiated the national “Hang Up on War” campaign, encouraging the refusal to pay the war-related federal excise tax on telephone service (then at 10%).

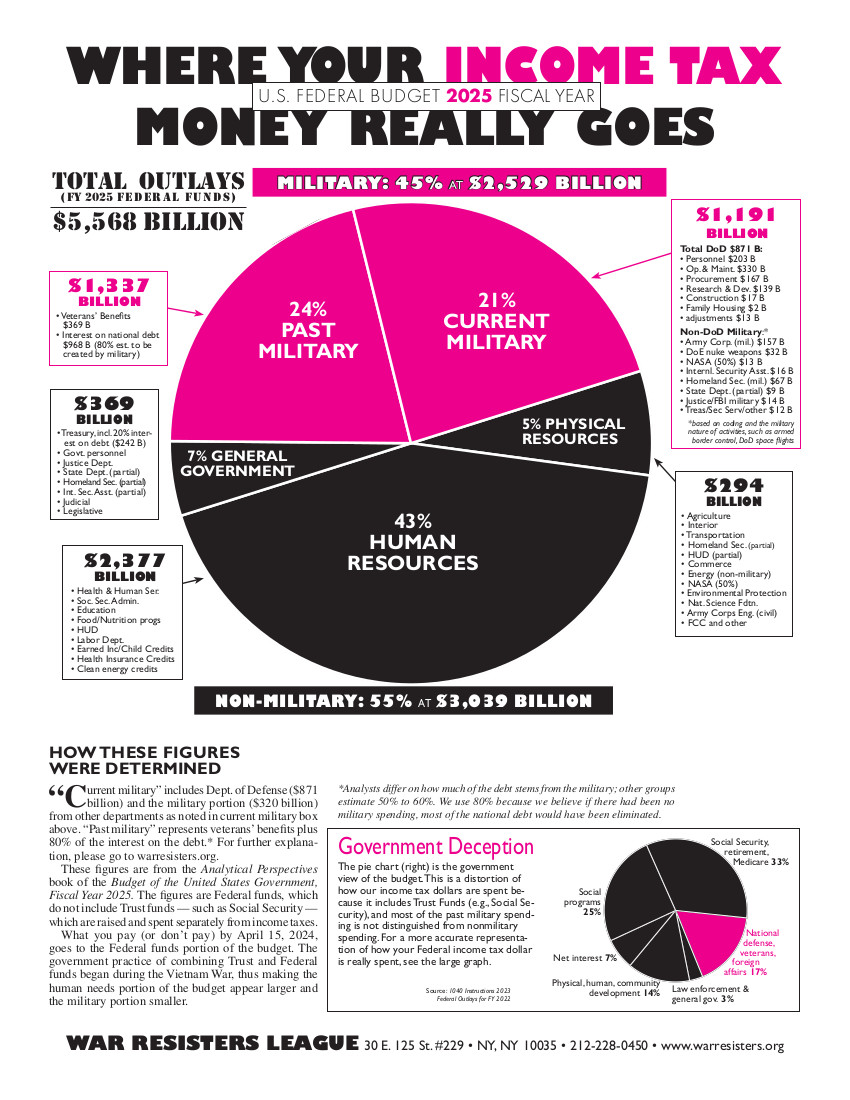

In 1981 WRL published Guide to War Tax Resistance and the next year helped found the National War Tax Resistance Coordinating Committee. In 1984, WRL produced the first annual "pie chart" analysis of the federal budget showing how U.S. income tax dollars are heavily skewed towards military spending.

In 1990, WRL introduced the Alternative Revenue Service to help taxpayers make a statement about U.S. military spending and to encourage resisting the taxes. In 2008 on the fifth anniversary of the U.S. invasion of Iraq, WRL organized a blockade of the national IRS in Washington, DC, where 33 were arrested.

In 1990, WRL introduced the Alternative Revenue Service to help taxpayers make a statement about U.S. military spending and to encourage resisting the taxes. In 2008 on the fifth anniversary of the U.S. invasion of Iraq, WRL organized a blockade of the national IRS in Washington, DC, where 33 were arrested.

Tax Day 2023, WRL with several organizations will once again be demonstrating in front of the IRS encouraging open refusal to pay taxes for war and demanding tax dollars be moved from the Pentagon to meeting more urgent human needs.

- Ed Hedemann