Between Credit, Bullion, and Rebellion

Between Credit, Bullion, and Rebellion

Debt: The First 5,000 Years

By David Graeber

2011, Melville House Publishing, 544 pages, $32

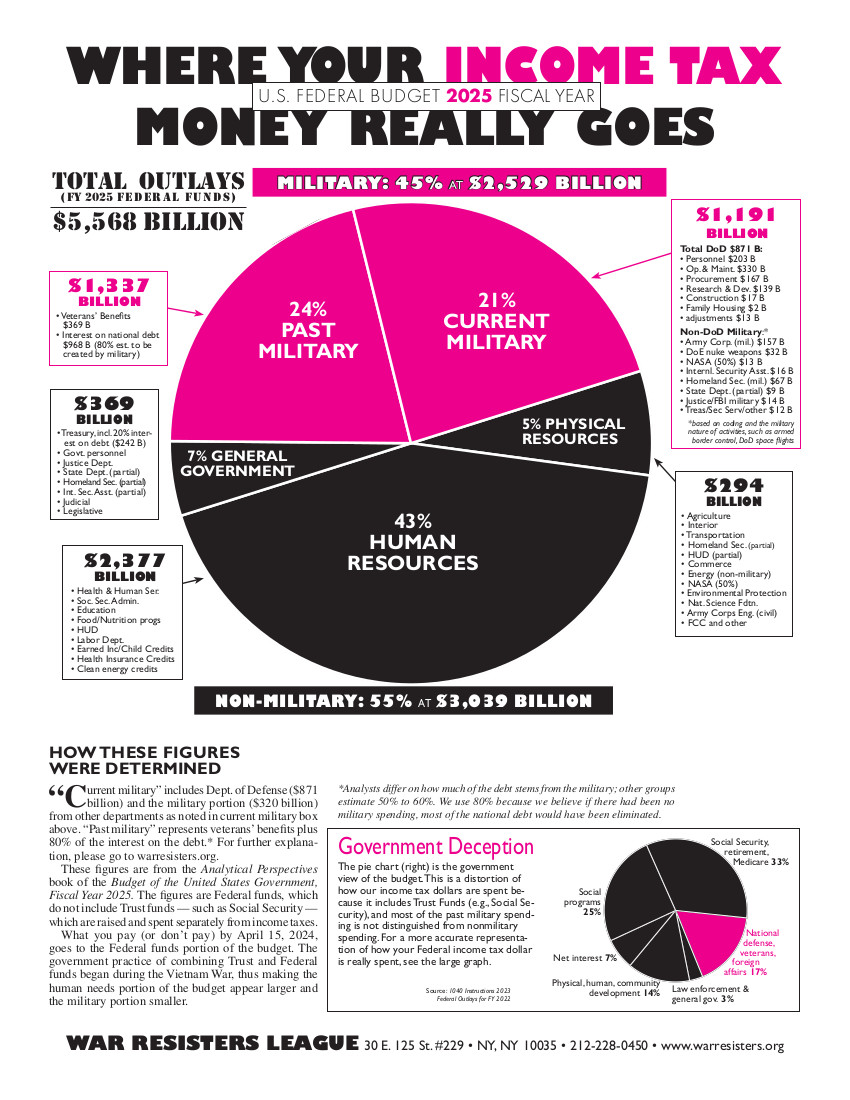

Right now, everyday people are feeling increasing stress from all directions. Pressure from the faltering economy, violence and warfare, debt/deficit worries, and austerity measures are approaching a breaking point. Human-scale economic considerations are being crushed beneath the massive weight of a worldwide permanent war economy and a bloated, lawless global financial system. The lingering 2008 financial crisis has sparked worldwide protest movements this year that are hunkered down and gaining momentum in the face of the immense financial stresses effecting all but the richest among us.

Into this moment of epochal crisis comes Debt: The First 5,000 Years, a book examining the history of the economic forces that seem permanently entrenched and that affect our lives profoundly. At times humorous and always thought-provoking, this engaging, thoroughly researched text presents a fascinating history of human financial systems and illustrates how changeable these systems actually appear when viewed over time. Graeber examines various aspects of economic mechanisms and systems of exchange, then journeys down a timeline of economic evolution, from around 800 BC through the present. Although, taken chapter by chapter, Debt is an accessible and interesting read, the book is also dense and detailed—and long.

The dynamic between debt and credit, and how they function, is Graeber’s primary focus. He examines how the experience of debt is different for economically disenfranchised people and countries in the global south compared to privileged people and wealthy countries. Deep contradictions and economic double standards have been at play for centuries, he notes, and have evolved into the power dynamics in force today. Graeber observes that the power and capacity to create violence determines how an entity—a country, for instance— experiences debt and the pressure to repay that debt. “In the final analysis,” he states simply, “the man with the gun doesn’t have to do anything he does not want to do.”

The underlying forces that govern which economic systems are employed throughout history are also dictated by the absence or presence of violence in the form of wars, military adventures, and empire building. To facilitate the maintenance of armies and the fighting of wars, gold and silver exchange markets replaced debt and credit systems—but not permanently. Throughout the last 5,000 years, Graeber explains, human society has shifted between credit and bullion or gold and silver exchange systems based on the presence of institutional violence. He explores how “violence, or the threat of violence, turns human relations into mathematics.”

The author observes that the 2008 financial crisis presented an opportunity for a conversation about how our current financial systems might once again be dismantled and/or reinvented, this time to more intentionally serve human needs rather than violence, power, and greed. But this conversation never really got started, the banks were never held accountable for their greed and incompetence, they never faced oversight or regulation, and the militarization of the economy was allowed to carry on. Graeber notes that, in the wake of that missed opportunity, the financial crisis has worsened, like a global economic flu.

Real people all over the world are enduring an accelerated degradation of their financial situations, loss of homes, the crush of consumer debt, mortgages and student loans, and draconian cuts in education, healthcare, and social welfare systems as the financial elite squeeze the last drops of blood from the world economy.

Graeber asks the question, “How did we get here?” He suspects that we are seeing and feeling the last stages of the complete militarization of American capitalism and speculates that “the last 30 years have seen the construction of a vast bureaucratic apparatus for the creation and maintenance of hopelessness, a giant machine designed, first and foremost, to destroy any sense of possible alternative futures.”

But he goes on to say that this ongoing crisis presents an opportunity for alternative solutions, conversations about debt forgiveness for economically vulnerable countries and people, and general reform of the system. Graeber writes that “to begin to free ourselves, the first thing we need to do is to see ourselves again as his-torical actors, as people who can make a difference in the course of world events. This is exactly what the militarization of history is trying to take away.”

Enter 2011, witnessing the widespread protests of the Arab Spring and Occupy Wall Street, movements that are gaining momentum, encouraging each other, and joining with the austerity protests breaking out all over Europe. The world appears poised for vast global rebellion, and people seem to be taking active roles in making change. Finally, it looks like the conversation that did not happen in 2008 is beginning in earnest.

Graeber points out that when economic pressure has reached critical points in the past, people have been able to work for change. Jubilee, or debt forgiveness, and re-distribution of resources have happened in many civilizations throughout history, and he posits that we have again reached exactly such a moment.

Graeber’s comments on debt forgiveness may seem revolutionary, but he is by no means alone in his argument. A 2009 article from Business Week describes one aspect of the growing movement for forgiving student debt to stimulate the economy. Many involved in this movement are making progress pressing their congressional representatives for debt forgiveness and income-based repayment relief legislation. Mortgage forgiveness for homeowners is being fiercely debated, but the prevailing sentiment is that any allowances for refinancing, principle forgiveness, or overall mortgage forgiveness would endanger the mortgage-backed securities industry. Graeber would likely argue that the unregulated proliferation of questionable mortgage products and predatory lending practices started the problem, so the companies and banks responsible should be made to pay—not taxpayers.

Debt forgiveness on a national scale is another discussion altogether. Graeber writes that when the slave population of Haiti won their independence in 1804, France levied a debt of reparations on the new country of 150 million francs, the equivalent of $18 billion today, a sum impossible to pay back. Haiti has staggered beneath the weight of that debt ever since and is, consequently, the poorest country in the world. Ongoing debate about forgiving Haiti’s debt intensified after an earthquake devastated the island country in January 2010. Some of that debt was forgiven, but Haiti still struggles under the burden of the more than $1 billion it owes to various countries and international entities, much of the more recent debt accumulating during the brutal reigns of Papa Doc and Baby Doc Duvalier.

Graeber also notes that loans to countries in the global south often end up in the bank accounts of dictators and not in the countries’ treasuries, and he questions the fairness of making these countries pay the debts, rather than demanding the money back from those who stole it from national treasuries. Recently, the post-Mubarak transitional government in Egypt has been working on lobbying their lender countries like the United States to forgive some or all of its national debts. The Obama administration is considering some form of debt forgiveness as part of its next aid package to Egypt.

Some countries that have been pushed to the brink of default by foreign debt have managed to negotiate refinancing terms with their creditors without the International Monetary Fund installing itself as the mandatory intermediary. Argentina, in debt restructuring negotiations with its creditors in the wake of its 2002 fiscal crisis, is one example.

Graeber says he wrote Debt in part to encourage people to begin to view economics as changeable and not monolithic and to spark some creative thinking about what the future of human beings might look like. He admits that it is anyone’s guess what might happen next, but he suggests that new forms of human exchange and cooperation—forms reliant on human compassion, creativity and love—can break with the forces that have sought continually to reduce human activity to commodity.

We are taking back power, restoring ourselves as engaged, creative, socially interactive beings, retrieved from the shrunken, two-dimensional roles as producers and consumers of goods and services to which accepted economics would relegate us. Debt: The First 5,000 Years is an attempt at understanding the past in order to understand the possibilities of this moment and our future economic survival. Human economics based on relationships and efforts based on creativity, love, and passion could form a new system from within the shell of the old. We can create a better system, forcing governments and financial institutions to forgive the debts of economically vulnerable people and countries, and reordering the future for people, not for armies and banks.