What would you do

if someone came to your door

with a cup in hand

asking for a contribution

to help buy guns

to kill a group of people

they didn't like?

— Wally Nelson

It is impossible to conduct modern warfare without soldiers and weapons. But before governments can buy weapons and hire soldiers, they must first raise the necessary money through taxes or borrowing. War tax resistance is refusing to pay some or all of those federal taxes that contribute to military spending.

Because there is no tax that goes only to the military, war taxes generally mean individual federal income taxes and as well as some excise taxes (e.g., federal excise taxes on alcohol, tobacco, or local landline telephone service). Though a case can be made to include Social Security, state, and local taxes, these are generally not considered “war taxes.”

“The two decisive powers of the government with respect to war are the power to

conscript and the power to tax.”

-- A.J. Muste

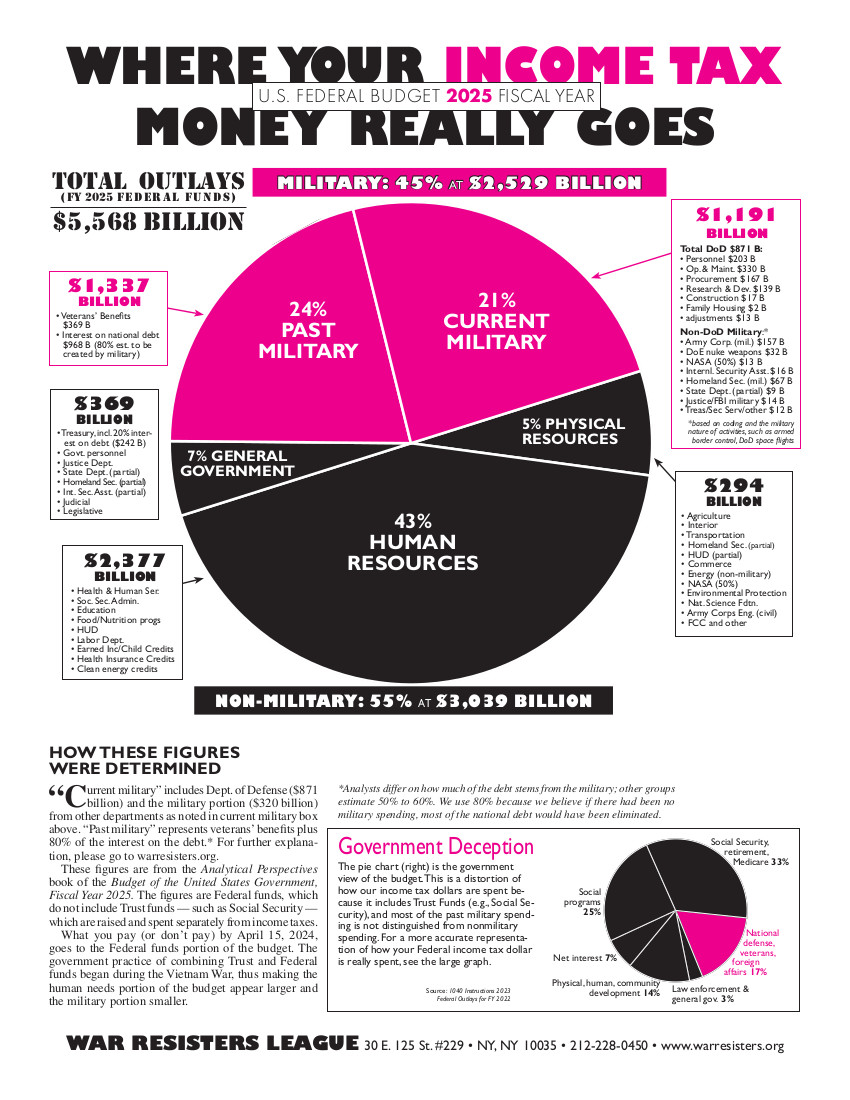

In this era of high-priced weapons systems and military aid to regional wars, taxation is the closest war-making link between the government and most citizens. War tax resistance represents a direct way to say “NO!” to military programs which cost U.S. taxpayers more than $1 trillion dollars annually. War tax resistance is a powerful way to say NO to nuclear weapons and weapons testing, military aid and arms sales, the ludicrous Star Wars missile defense system, covert CIA violence — to say NO to the militarization of the U.S. federal budget. Through war tax resistance you control how your money is spent.

“If a thousand men [and women] were not to pay their tax-bills this year, that would not

be a violent and bloody measure, as it would to pay them, and enable the State to commit

violence and shed innocent blood.”

—Henry David Thoreau

Why Resist?

This waste of money and human resources demands strong action from us all. War tax resistance is one direct way to protest militaristic policies. Governments depend on people agreeing with, or at least not actively opposing, their polices. War tax resistance is a personally empowering means . . .

- to withdraw support from the war-making machinery in a way that the government will find hard to ignore

- to redirect tax money to more productive ventures that meet human needs and promote a more responsible and sustainable relationship with the earth

- to encourage others to resist

- to make one’s life more consistent with one’s beliefs.

There are a number of legal precedents that tax resisters have cited to justify their resistance. Notable examples are from the Nuremberg Principles, the United Nations Charter and the United States Constitution. To date, however, no federal courts have accepted these precedents for war tax resistance.

The War Resisters League works with war tax resisters and works with NWTRCC, the National War Tax Resistance Coordinating Committee, and other war tax resistance groups.

WRL produces the annual "federal budget "Pie Chart" flyer, Where Your Income Tax Money Really Goes, the comprehensive book War Tax Resistance: A Guide to Withholding Your Support from the Military and other resources (including the 2024 Update to the Guide to Withholding Your Support from the Military). All are available on our online store, along with NWTRCC's important DVD, Death & Taxes.

More information and resources on War Tax Resistance: